Let’s talk about making money in the stock market, the smart way: by trading stock trends! But what exactly makes up a trend? I’m glad you asked.

Remember those stock market stages we talked about?

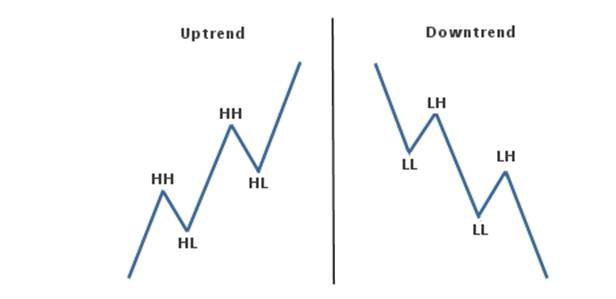

Well, Stage 2 is where the party’s at – it’s an uptrend marked by higher highs (HH) and higher lows (HL). Conversely, Stage 4 is a downtrend with lower highs (LH) and lower lows (LL). This creates peaks and valleys on the chart that you can trade profitably.

Now, feast your eyes on the beautiful anatomy of stock trends:

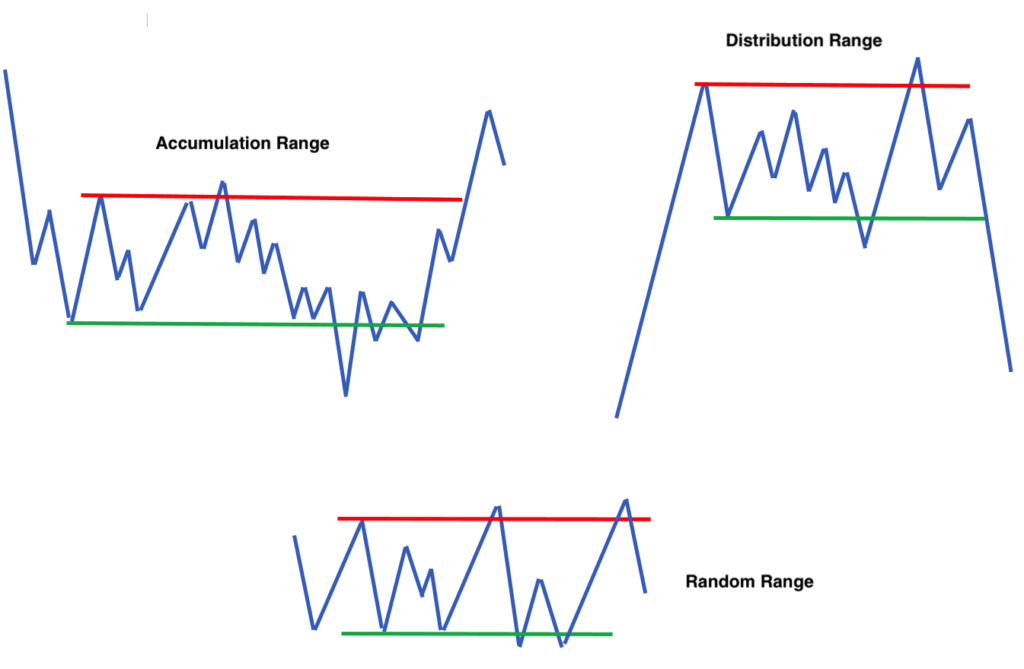

But hold up! Did you know that stocks only trend about 30% of the time? The rest of the time, they’re stuck in sideways trading ranges, like this:

Yeah, those ranges can get messy! There’s no point in wasting your time and money on stocks stuck in trading ranges (that’s Stage 1 and Stage 3). Stick to the trends!

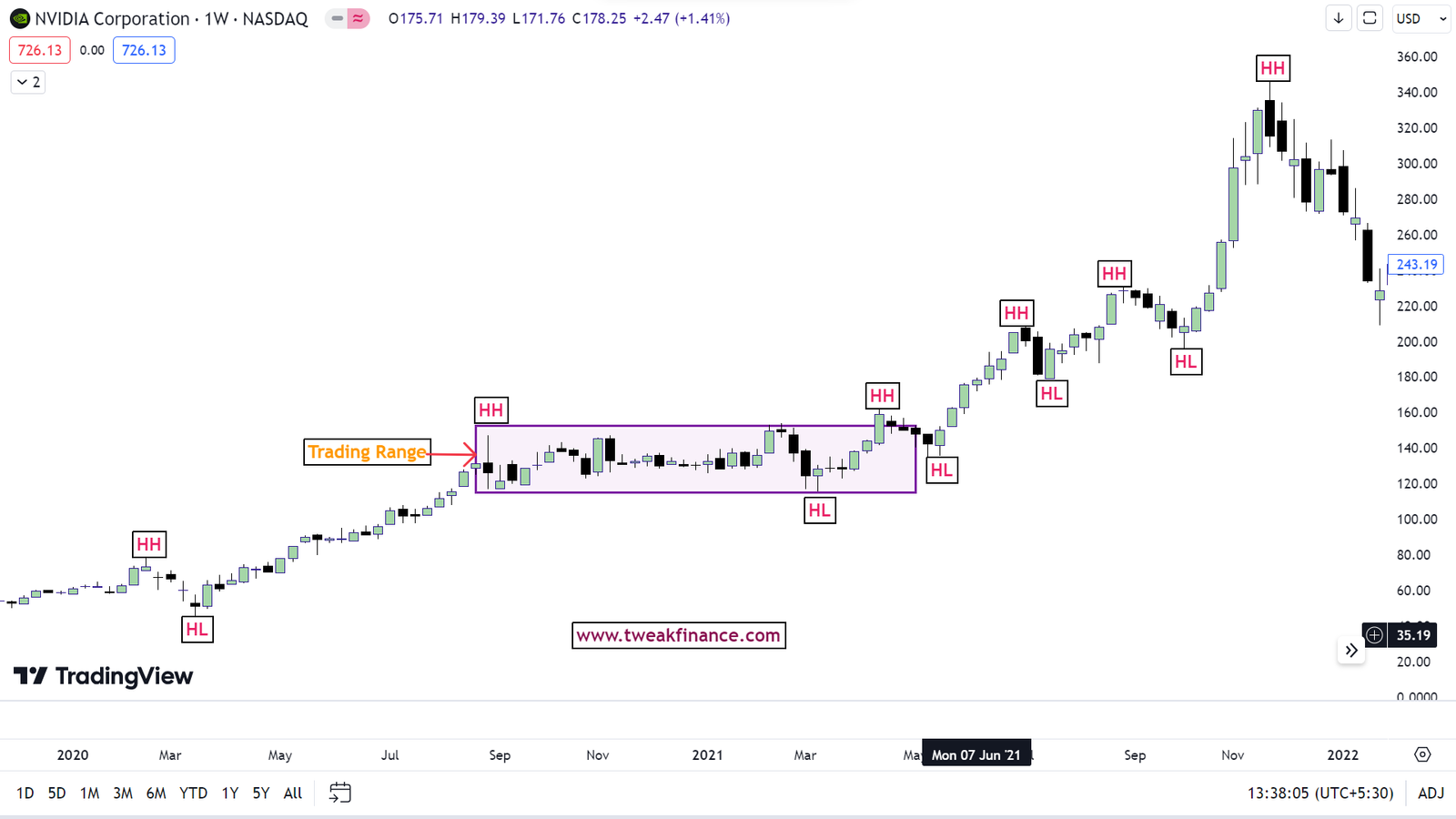

Uptrend Trending stock example:

Downtrend Trending stock example:

Take a look at this stock in a nice downtrend:

Trading Range stock example:

And compare it to this one stuck in a trading range:

See the difference? It’s like night and day!

Now, here’s the kicker: if you check out any stock in a strong uptrend, you’ll notice that the pullbacks are short-lived. That’s your cue to buy before it heads back up. Same deal with stocks in downtrends – the rallies are brief, giving you a chance to short them.

So, let’s trade smart and stick to the trends!

Have questions, suggestions, or topics you’d like us to cover? We’d love to hear from you! Please check About us.

Disclaimer:

The information provided in this finance blog is for general informational purposes only. It does not constitute financial advice, and readers are encouraged to consult with a qualified financial advisor for personalized guidance. The author is not liable for any financial decisions or actions based on this blog’s content. Investments involve risks, and past performance is not indicative of future results. Always conduct thorough research and consider your financial circumstances before making any investment decisions.