Embarking on the journey of trading is an exciting venture, but having a reliable Intraday Trading Strategy is the key to navigating the unpredictable markets. In this guide, we’ll explore an effective tool that could become your trading ally—the Supertrend Indicator. Let’s delve into the world of trends and discover how this indicator can elevate your trading game.

Table of Contents

What is Supertrend Indicator

The Supertrend Indicator isn’t as complex as it sounds. Supertrend analyzes the Average True Range (ATR) or the stock’s volatility to generate reliable buy and sell signals. These signals serve as your cues to enter or exit trades, ensuring you’re in sync with the market rhythm. Beyond generating signals, Supertrend doubles as a dynamic trailing stop-loss for your existing trades.

This feature helps protect your gains by adjusting to the changing market conditions.

Trend Identification Made Easy

Say goodbye to squinting at confusing charts. The Supertrend helps you identify trends effortlessly. When the price is above the Supertrend line, it’s a green light for an uptrend. Conversely, if it’s below, get ready for a potential downtrend.

Setting Up Your Environment for Intraday trading Strategy

Integrating Supertrend into Your Chart

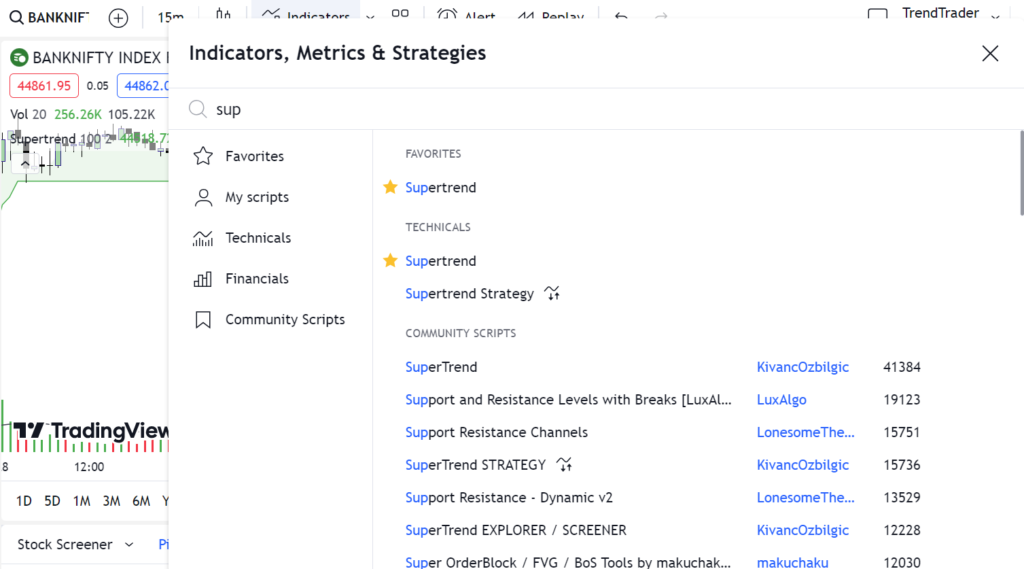

Worried about a tech hiccup? Fear not. We’ll guide you step by step on how to apply the Supertrend indicator on your trading platform. Screenshots included for a stress-free setup.

Please refer below screenshot to plot Supertrend indicator in tradingview.

To plot Supertrend indicator in Zerodha. Please checkout Settings link.

Choosing the Right Parameters

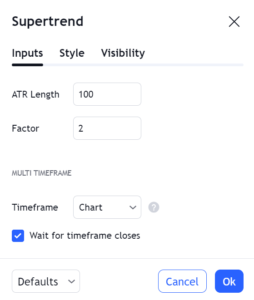

Picking the right settings is like finding the perfect outfit—it depends on the occasion. Adjust the ATR period and multiplier to suit the market’s rhythm. Think of it as tailoring your Supertrend to fit different market vibes.

We are using Supertrend (100,2) setting. Please check below screenshot.

Core Intraday Trading Strategy

Time Frame

Stick to the 15-minute time frame.

Stoploss

Set your stoploss just below the Supertrend indicator.

Short Trade Criteria

Only initiate a buy when the high of the 1st red candle breaks, coinciding with the Supertrend changing color from red to green.

Conservative traders be patient and wait for the candle to close above this newfound high before entering the trade.

Aggressive traders initiate a buy when the high of the 1st red candle breaks

Please checkout below Long Trade Setup Example:

Short Trade Setup

Time Frame

Stick to the 15-minute time frame.

Stoploss

Set your stoploss just above the Supertrend indicator.

Short Trade Criteria

Only initiate a sell when the low of the 1st green candle breaks, coinciding with the Supertrend changing color from green to red.

Conservative traders be patient and wait for the candle to close below this newfound low before entering the trade.

Aggressive traders initiate a sell when the low of the 1st green candle breaks

Please checkout below Short Trade Setup Example:

Risk Reward

Additionally, it’s crucial for traders not to overlook the significance of when to exit a trade. This is particularly vital in a trend-following strategy, where the decision to exit can significantly impact the success or failure of the overall trading approach. In a trend-following strategy, the primary objective is to optimize large winners by catching long-lasting trending phase.

Understand that this strategy is all about following trends. While the win rate might be lower than 50%, So when making a trade plan, aim for a risk-reward ratio that is greater than 1:3.

Fake Breakout and Breakdown

This Intraday trading strategy saves us from false breakout and breakdown on most o the times. Please checkout below example.

Combining Supertrend with Other Indicators

Just like a well-mixed cocktail, combining the Supertrend with other indicators elevates the taste. Uncover the magic of pairing it with complementary tools for a robust strategy. We will post detailed article on this.

Conclusion

In conclusion, the Supertrend Indicator isn’t just a line on your chart—it’s a potential game-changer. Recap the highlights, and remember, practice makes perfect. So, strap in, follow the Supertrend, and let’s ride the waves of trading success together.

Have questions, suggestions, or topics you’d like us to cover? We’d love to hear from you! Please check About us.

Disclaimer:

The information provided in this finance blog is for general informational purposes only. It does not constitute financial advice, and readers are encouraged to consult with a qualified financial advisor for personalized guidance. The author is not liable for any financial decisions or actions taken based on the content of this blog. Investments involve risks, and past performance is not indicative of future results. Always conduct thorough research and consider your individual financial circumstances before making any investment decisions.