To trade stocks successfully, you must first understand the four stock market stages of individual stocks and the overall market. These cycles tell you if you should be long, short, or in cash.

Once you can identify what stage it is in, you can then trade accordingly to those characteristics.

After a while, you won’t even have to think about whether you should be long or short. You will be able to know, without question, exactly what you should be doing NOW. You will either focus on long and short positions or stay safely in cash – just by glancing at a chart!

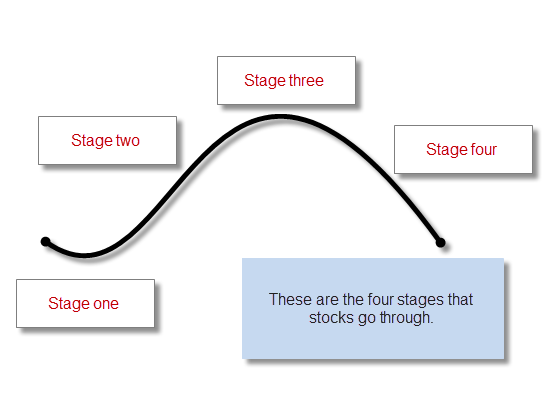

Here are the four stages that stocks go through. This happens across all time frames, whether you’re looking at a monthly chart, a weekly chart, a daily chart, or even an intraday chart.

Ok, so I’m not the best artist in the world but I think it will serve our purpose here! What? You thought it would be more complicated than that? My philosophy on the stock market is that if it is too complicated then it is just not worth doing. Now, we’ll look at the characteristics of the four stock market stages. I promise it will be painless!

Let’s break down the stock market stages and how stocks behave in simpler terms:

Stage one:

This is what happens right after a long period of prices dropping. The stock was going down, but now it’s kind of just moving sideways, forming a base. The folks who used to sell a lot are losing their power because more people are starting to buy. The stock isn’t going up or down much. Nobody’s too thrilled about this stock at this point!

Stage two:

Now we’re talking! This is when stocks break out into Stage 2 and start going up. Oh, the excitement of Stage 2! Sometimes I daydream about stocks in Stage 2! This is where most of the money gets made in the stock market. But here’s the funny part: nobody’s really buying into the idea of the stock going up! Yep, everyone still hates it. They say the company’s not doing well, things look bleak, and so on. But the pros know better. They’re buying up shares and getting ready to sell them to the latecomers. And that leads us to Stage 3.

Stage three:

After the exciting run of Stage 2, the stock starts to level off again and kind of just moves sideways. Now, all the newbies are jumping in! This stage feels a lot like Stage 1. Buyers and sellers are on more even ground, and the stock just kind of hangs out. It’s getting ready for the next move.

Stage four:

This is when things take a turn for the worse for those holding onto this stock. But guess what? Yep, nobody’s really buying into the idea of the stock going down! They still think it’s great and that the downturn is just a temporary blip. Nope! They keep holding on, hoping it’ll turn around. They probably bought in when things were looking good in Stage 2 or during Stage 3. Tough break, huh? Game over!

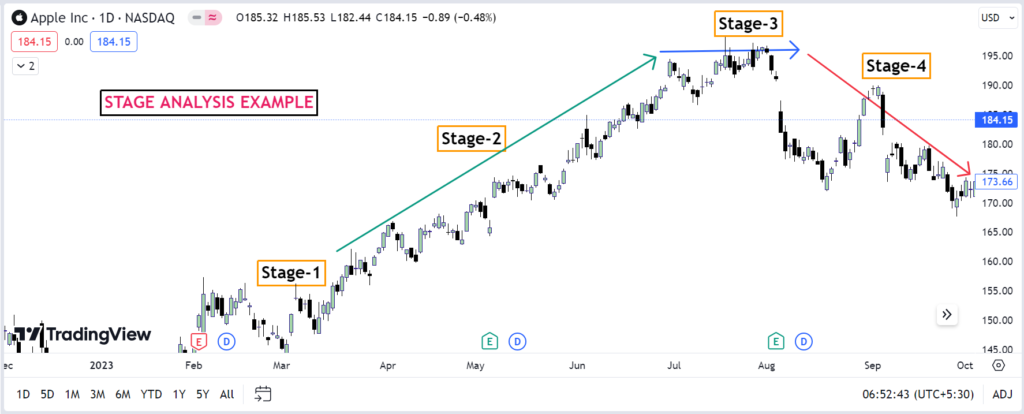

And there you have it! Let me show you the stock market stages with an example:

Stock market stages occur in all time frames on every chart. This could be a fifteen-minute chart of Amazon or a weekly chart of the Dow.

Generally, you want to stay in cash when a stock (or the market itself) is chopping around in stage one. In stage two you will want to be aggressively focusing on long positions. In stage three you want to be in cash. In stage four you want to be aggressively focusing on short positions.

But, here is where it gets a little tricky: Within each stage are waves. You can learn more about these waves on the Elliott Wave page.

That’s all there is to it. I told you that trading with stock market stages would be painless!

Have questions, suggestions, or topics you’d like us to cover? We’d love to hear from you! Please check About us.

Disclaimer:

The information provided in this finance blog is for general informational purposes only. It does not constitute financial advice, and readers are encouraged to consult with a qualified financial advisor for personalized guidance. The author is not liable for any financial decisions or actions taken based on the content of this blog. Investments involve risks, and past performance is not indicative of future results. Always conduct thorough research and consider your individual financial circumstances before making any investment decisions.

Informative content that is easy to understand accomapnished by visuals wherever required.