Overview:

Tips Industries Limited, incorporated in 1996, is, has been engaged in the business of creation and acquisition of audio-visual content for music and exploitation of audio-visual content library digitally in India and overseas through licensing on various distribution platforms.

The Company has a widespread presence across leading global digital platforms such as YouTube, Spotify, Jio Saavn, Resso, Apple Music and Amazon Prime etc

Industry Analysis:

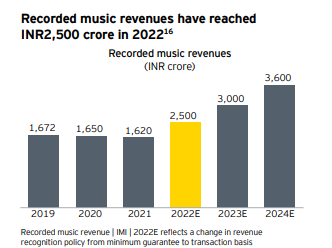

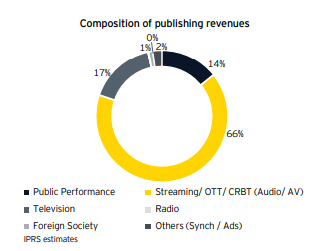

As per a report by EY the recorded music revenues of labels have crossed INR2500 crore by 2022 while music publishing revenue approximated INR884 crore. The estimated growth rate is between 20% to 30%.

Business Analysis

TIPS until 2021 had both the music and film businesses under one entity.

To unlock shareholders’ value they separated the music and film business via a demerger Tips Industries ltd (Music ) and Tips Films ltd (Movie business)

TIPS Industries has rich and evergreen music collection. Its large and diversified music library has a collection of over 30,000 songs across all genres and major languages.

The Company has a widespread presence across leading global digital platforms such as YouTube, Spotify, Jio Saavn, Resso, Apple Music. Amazon Prime etc. As of March 2023, on YouTube, Tips Music has more than 82 mn subscribers across its channels and received 112.7 billion views.

Company entered a deal with Warner ADA in 2020 to distribute Tips’ music repertoire through warner music India domestically and through ADA oversees on spotify. Spotify pays Warner while Tips gets paid by Warner

Company has also entered a deal with Sony music group and Facebook the revenues from which are yet to be realized

Content Partners

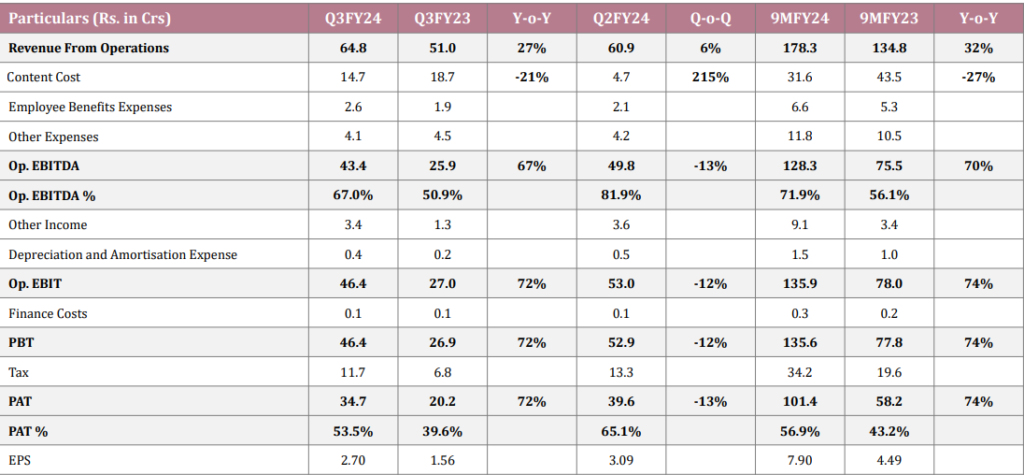

Financial Statements

Source : corporate filing Tips Industries

Company writes off 100% of content cost from the P&L statement in the quarter of release .No pending write offs and capitalization in the future .

Company does not use leverage / debts to acquire content .It is funded using the internal accruals

Company is cost conscious so they don’t over pay for any content. They acquire content from producers only when they see profitability in the venture

Price Analysis::

The Current market price of Tips is around INR507

Company has a healthy Dividend yield of 1.18%

It has an outstanding ROE of 64%

Currently the stock P/E is 54.4 giving it a Market Cap of INR6517 CR

Stock has delivered a 235% return in the past 1 year with a 3 year return of 1056.5%

What works

Company is sitting on cash of nearly 180 crores.

Company has plans to buyback shares and pay dividends.

Company working with a very high margin of close to 70% which is commendable.

PAT growth is around 53% in the most recent quarter .Company has their long term estimates of 30% top line and 35 to 40% bottom line.

Company is almost debt free.

Company recognizes the dangers of paying high cost of acquisitions and leverage which is a sign of a good management

What does not work

Catalogue not as huge as competitors .

Too dependent on the old catalogues not many chartbusters from the current lot when compared with competitors

There is a possibility that current generation may not listen as much to Tips as they may not relate to the music of 1990s or the early 2000s

Company is planning to recycle at least 3 to 4 old hit songs every year which may indicate the dearth of new contents

Tips has major competition from Tseries, ZEE music , and Sony .

Tseries is the most subscribed channel on youtube with a huge catalog of musics spanning generations.

Even Zee and sony have a lot of songs that are relevant for the current generation

Verdict

Tips industries buoyed by robust earnings growth and the explosion in the digital music has potential to provide a lot of value to the shareholders

Having said that, they need to work on new contents which can generate more listening by the young generation .

This can help in sustaining the current high growth rate that the company is generating.

Have questions, suggestions, or topics you’d like us to cover? We’d love to hear from you! Please check About us.

Disclaimer:

The information provided in this finance blog is for general informational purposes only. It does not constitute financial advice, and readers are encouraged to consult with a qualified financial advisor for personalized guidance. The author is not liable for any financial decisions or actions based on this blog’s content. Investments involve risks, and past performance is not indicative of future results. Always conduct thorough research and consider your financial circumstances before making any investment decisions.