In the fast-moving world of intraday trading, having the right tools can greatly impact your success. One tool that seasoned traders vouch for is the Volume Weighted Average Price (VWAP). In this guide, we’ll explore how to use VWAP like a pro trader and simple vwap trading strategy, with charts and images to make it easy to understand.

Table of Contents

Let’s start by understanding what VWAP is and how to use it effectively for trading.

What is VWAP Indicator

VWAP stands for Volume Weighted Average Price. It’s a dynamic indicator that considers both the price and trading volume. Essentially, VWAP calculates the average price of a security throughout the trading day, taking into account the volume traded at each price level. This makes it a valuable tool for intraday traders, helping them gauge market sentiment and make informed decisions.

For instance, if a portfolio manager needs to buy a large number of shares but wants to pay less than the day’s average price, VWAP is typically the target price.

The Importance of VWAP

Because VWAP incorporates both price and volume into its value, analysts believe it reflects a stock’s true average price more accurately. VWAP is independent of a stock’s closing price and doesn’t directly affect it.

Institutional traders use VWAP as a reference for trading executions, making the VWAP price level highly influential in intraday price action.

Using VWAP

Experienced traders understand that institutional traders use VWAP as a reference point, and recognizing this dynamic is crucial for your trading strategy.

You can use VWAP as a filter, believing that buyers are more likely to support the price when it falls and touches VWAP. On the flip side, you might consider buying a stock only when the price is higher than VWAP and short-selling when the price is lower.

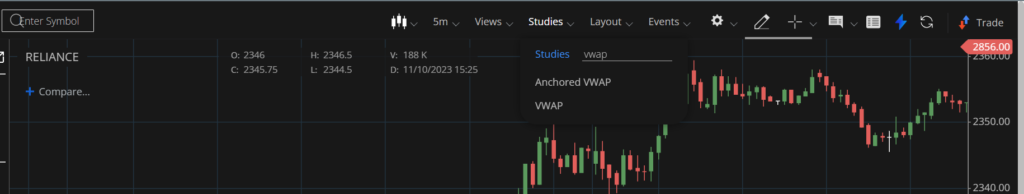

you can add vwap indicator by simply searching under studies and apply it on chart with default setting.

VWAP Trading Strategy and Examples

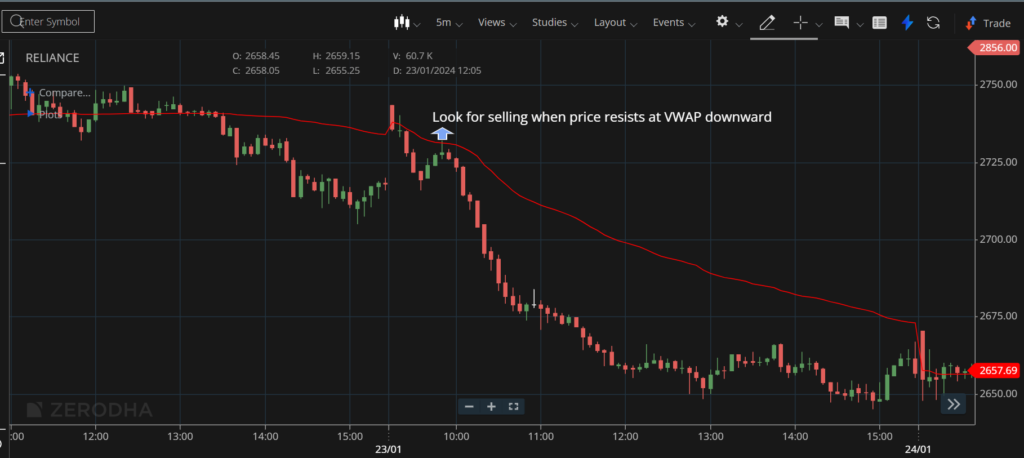

VWAP is an intraday market indicator that helps traders decide whether to enter positions actively or passively. Two common setups are pullbacks and breakouts.

Pullback VWAP Trading Strategy

Long Trades

If the market price is above VWAP and holds as support, it can signal entry for long trades.

Short Trades

When the market price is below VWAP and it acts as resistance, it may indicate short trade opportunities.

Breakout VWAP Trading Strategy

This setup is for those unfamiliar with the VWAP indicator. Wait for an asset to test VWAP to the downside, then wait for it to close with strong bullish candle above VWAP. Buy over the high of the bullish candle that closed above VWAP.

Advantages of Using VWAP

- Helps traders cut through the noise and benchmark the current price against VWAP.

- Allows quick determination of whether quantities are being bought or sold at low or high rates.

- Enables traders to buy or sell at the correct price (VWAP) instead of entering a trade at current rates.

- Particularly useful for major traders like institutions to trade at the best possible price.

Bottom Line

When combined with market action or other technical trading techniques, the VWAP indicator can simplify the decision-making process. It’s essential to integrate VWAP approaches with other price action studies for effective trading.

Conclusion

In conclusion, the VWAP Indicator isn’t just a line on your chart—it’s a potential game-changer. Recap the highlights, and remember, practice makes perfect. So, strap in, follow the VWAP, and let’s ride the waves of trading success together.

Have questions, suggestions, or topics you’d like us to cover? We’d love to hear from you! Please check About us.

Disclaimer:

The information provided in this finance blog is for general informational purposes only. It does not constitute financial advice, and readers are encouraged to consult with a qualified financial advisor for personalized guidance. The author is not liable for any financial decisions or actions taken based on the content of this blog. Investments involve risks, and past performance is not indicative of future results. Always conduct thorough research and consider your individual financial circumstances before making any investment decisions.